Sioen present at Techtextil 2024

From 23 to 26 April, we will be present at Techtextil. We have been exhibiting at this leading international trade fair for technical textiles since the 1980s.

3 min reading time

Shaping your future with technical textiles

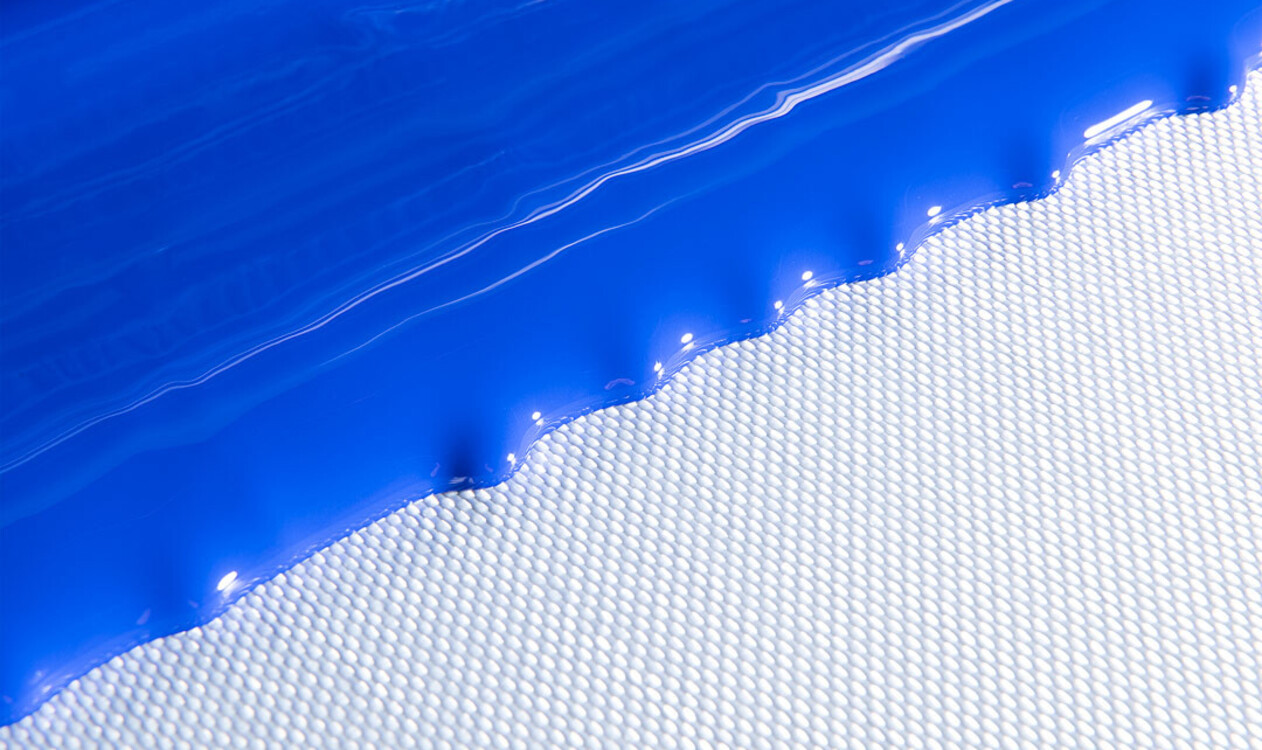

Welcome to Sioen, where we do more than just make fabrics — we innovate safety. Leading the way in technical textiles, we design essential solutions for sectors including firefighting, construction, and maritime. From pioneering PVC-coated textiles to developing durable geotextiles, our creations ensure quality and reliability.

Global reach

Sioen's technical textiles and protective wear are trusted by professionals worldwide. Our extensive network ensures that our innovative solutions are accessible in every corner of the globe.

Quality Control

Our rigorous testing processes and state-of-the-art facilities guarantee that every product not only meets but exceeds global standards, ensuring reliability in every thread.

Research & Innovation

Our dedicated teams dive deep into the science of textiles, pioneering new materials and techniques that redefine industry standards and push the boundaries of what's possible.

At Sioen, we innovate across three core divisions: dive deeper and discover the breadth of Sioen’s textile engineering excellence, subtly present in the fabric of everyday life.

We create technical textiles designed for specific tasks across various markets like transport, industry & construction.

We specialise in creating custom and standard colouring solutions, including high-quality pigment dispersions, inks, and varnishes.

We offer unrivalled expertise in professional protective clothing, which can shield you from any risk.

Transportation & automotive

Maritime & Fishing

Industry & construction

Public safety & Security

Sports & Leisure

Fire & Rescue

Forestry & Agriculture

Food & Storage

Publicity & events

Energy

Landscape & Architecture

Sioen embraces the triple bottom line: People, Planet, Profit. Our commitment to environmental care, social empowerment, and sustainable profit guides every innovation and decision. By integrating responsible practices into our core, we aim to make a lasting impact on the world and lead by example in our industry.